James Baker | Thursday, 09 December 2021

FELIXSTOWE, the UK’s largest container port, has had most vessel calls cancelled of any European port, as carriers seek to avoid those terminals affected by congestion.

Carriers are skipping port calls as they seek to avoid congestion and restore schedule reliability. Europe’s top ports all saw vessel calls decrease as schedules were revised

Figures from Alphaliner comparing actual ship calls with pro forma schedules for the period from July to December show that almost one third of Felixstowe’s calls were omitted.

“Our survey clearly shows that Felixstowe was worst hit by the temporary schedule changes and ad hoc adjustments,” Alphaliner said. “The top-three ports, Rotterdam, Antwerp and Hamburg, also saw a reduction of between 20.2% to 30.3% of planned calls. Smaller ports have fared much better.”

The 18 Asia–northern Europe loops operated by the three mega alliances skipped a total of 383 port calls in northern Europe over the past five months due to severe port congestion, it added.

The figure represents nearly a quarter of all scheduled calls in the period.

The addition of 77 ad hoc inducement calls had only partly compensated for these port omissions, Alphaliner said.

“The majority of inducement calls were made in the smaller ports of Wilhelmshaven (24), Bremerhaven (16), Le Havre (11) and Zeebrugge (8), which unsurprisingly posted the biggest growth in third-quarter traffic.”

Port calls were being omitted for a variety of reasons, it noted.

The first of these was ad hoc omissions of certain ports on specific voyages, to avoid congestion-related delays.

Others, however, were due to the temporary removal or transfer of calls for a period of time in an effort to restore schedule reliability.

“Many of these temporary adjustments have already been extended to March 2022 due to ongoing port congestion,” Alphaliner said.

But there were also a large number of blanked sailings which were caused by the late arrival of ships at ports of origin.

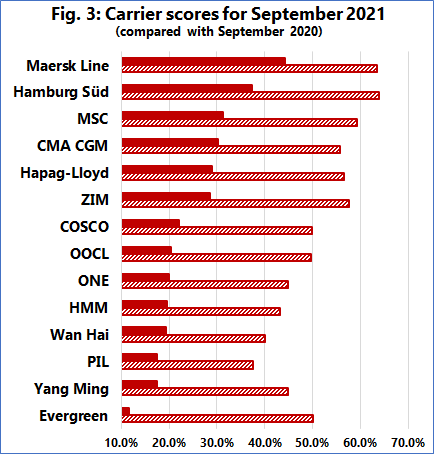

“This is especially the case for The Alliance’s ships, which continue to maintain the majority of their calls in Europe, thus leading to much longer round-voyage durations. The late arrival of ships in the Far East has forced Hapag-Lloyd, ONE, HMM and Yang Ming to regularly blank sailings.”

Carriers had also stopped doing double calls at some ports, on both the inbound and outbound voyage. This had been seen at Rotterdam, which recorded a 25% fall in scheduled calls.

At Felixstowe, which received only 104 of the 154 calls scheduled during the period, the number of calls from its key 2M alliance was reduced to just three in October, when UK import cargo on the AE7/Condor service was redirected to Wilhemshaven and Antwerp.

But the drop in Asia calls in the third quarter of this year did not affect container throughput at the top-three European ports, Rotterdam, Antwerp and Hamburg, in the period from January to September.

Rotterdam achieved container growth of 7.8% in the first nine months of the year to reach 11.5m teu, despite a 25.6% drop in Asia calls in the July-November period.

Antwerp, however, lost some market share as container traffic growth was limited to 2.8%, at 9.1m teu.

Hamburg, the third-busiest port in Europe, managed to increase liftings by 2.4% to 6.5m teu.

But Alphaliner noted that its smaller rivals at Bremerhaven and Wilhelmshaven had seen gains of 10% and 49% respectively, as carriers sought less crowded terminals.